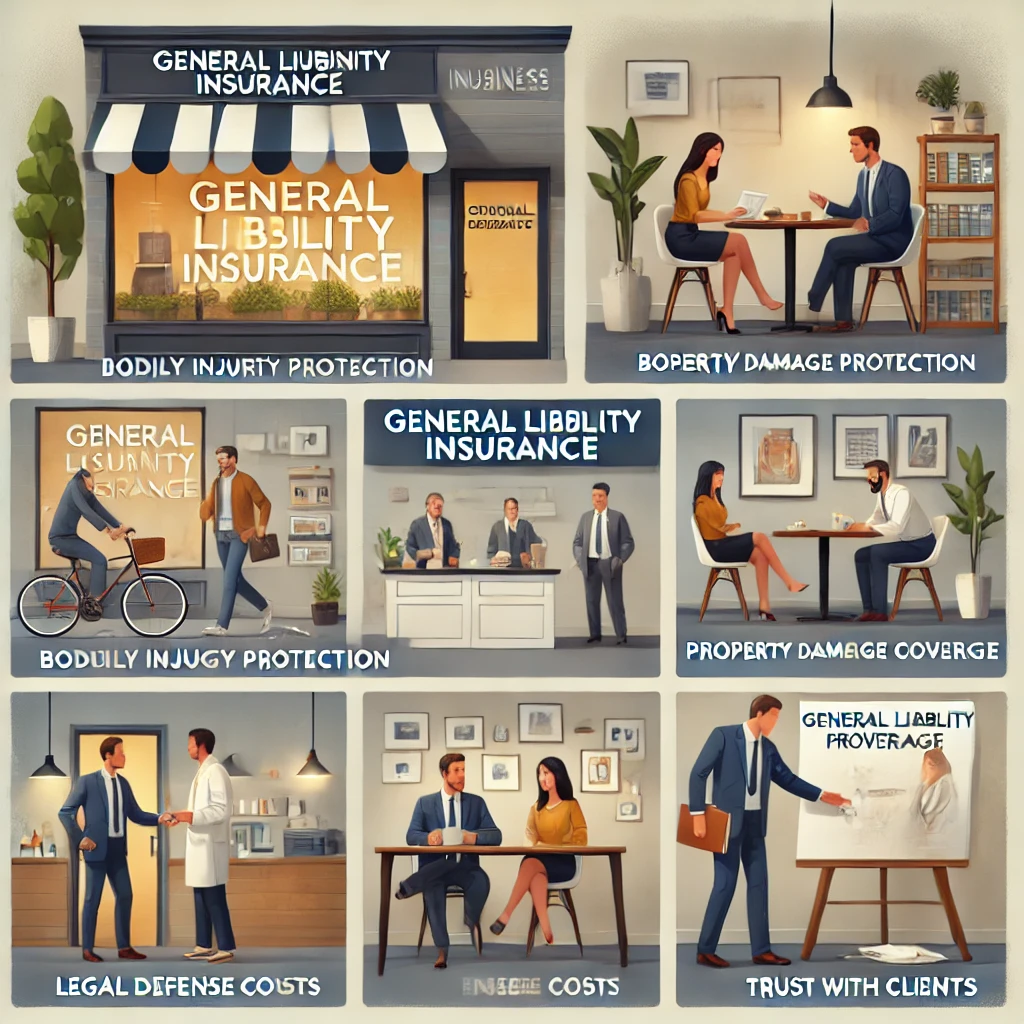

5 Reasons Why General Liability Insurance is Essential for Small Businesses

Introduction

5 Reasons Why General Liability Insurance is Essential for Small Businesses! General liability insurance is a critical safeguard for small businesses, offering protection against a wide range of potential claims that could arise during normal operations. This coverage is particularly essential for small business protection as it addresses issues like bodily injuries, property damage, and reputational harm. With four out of ten small business owners likely to face a general liability claim within the next decade, having this insurance in place can be a financial lifesaver. In this article, we will explore five compelling reasons why small businesses should prioritize obtaining general liability insurance. Understanding these reasons will help you make informed decisions about protecting your business and ensuring its long-term success. Whether you’re an independent contractor or running a bustling firm, general liability insurance for small business can provide peace of mind and enhance credibility with clients.

Protection Against Bodily

Injury Claims Securing general liability insurance is crucial for safeguarding your business against claims related to bodily injury. This form of insurance provides coverage when a customer or visitor sustains an injury on your premises. It plays a vital role in ensuring customer safety and protecting your business from potential lawsuits. For small business owners, incidents leading to bodily injury claims are not uncommon. Consider common scenarios such as: • Slips and Falls: A customer trips over an uneven floor or a wet surface in your store, resulting in an injury that requires medical attention. • Falling Objects: Merchandise or equipment accidentally falls and injures a customer, prompting them to seek compensation for medical expenses. • Accidental Collisions: In a busy café or restaurant, a staff member inadvertently collides with patrons, causing injuries.

In each of these instances, general liability insurance can cover medical expenses, legal fees, and even settlements if necessary. This type of coverage is especially important given the unpredictable nature of such incidents and the significant financial burden they can impose on small businesses. By preparing for premises liability issues through general liability insurance, you ensure that unexpected accidents do not derail your operations or strain your resources. This proactive measure not only shields you from financial loss but also reinforces your commitment to maintaining a safe environment for everyone who enters your premises.

Coverage for Property Damage

General liability insurance is crucial for protecting small businesses from the financial consequences of property damage. As a business owner, it’s not uncommon to accidentally damage a client’s property while carrying out your operations, which can result in expensive repairs or replacements.

General liability insurance offers protection against claims for damage to clients’ belongings that occur during business activities. This coverage ensures that your business won’t have to bear the entire financial burden if an incident happens, providing you with the support needed to effectively address such situations. Real-Life Examples • Contractor Mishap: Picture a contractor working on a renovation project in a client’s home. During the job, an accidental spill of paint damages an expensive carpet. The cost of replacing or fixing the carpet could be significant. With general liability insurance, these expenses may be covered, helping reduce unexpected costs. • Retail Store Incident: In a retail setting, an employee might accidentally knock over and damage a customer’s smartphone or other personal belongings. Such incidents can occur quickly and unexpectedly, leaving your business responsible for compensation without sufficient coverage. These situations emphasize the importance of having appropriate insurance to handle unforeseen events involving clients’ property. For small businesses operating in environments where they often interact with customer possessions— such as salons, photography studios, or service-based companies—general liability insurance is invaluable.

Legal Defense Costs Legal

challenges can be daunting for small business owners, but with general liability insurance, the financial burden of legal defense is significantly alleviated. This type of insurance plays a crucial role in covering the legal fees associated with lawsuits filed against your business. Whether it’s a dispute over service delivery or an accident on your premises, lawsuits can arise without warning and demand substantial resources to manage. Without adequate coverage, the costs of defending against claims could be financially crippling. Consider this: legal fees include attorney charges, court costs, and potential settlements or judgments, which can easily run into tens of thousands of dollars. For a small business operating on tight margins, these expenses could mean the difference between survival and closure. Why General Liability Insurance is Important for Legal Defense General liability insurance provides essential protection for small businesses facing legal challenges. Here’s why it matters: • Financial Security: By investing in general liability insurance, you secure financial support that protects your business’s assets from being depleted by unexpected legal battles. • Risk Management: This coverage allows you to focus on growing your business rather than worrying about potential litigation and its associated costs. It’s a vital aspect of your overall risk management strategy. For example, if a customer files a lawsuit claiming injury due to negligence at your place of business, legal defense costs would quickly accumulate. General liability insurance not only provides coverage for such scenarios but also offers peace of mind knowing that professional help is available to navigate complex legal landscapes. In essence, having general liability insurance ensures that your small business has a safety net against unforeseen legal challenges, allowing you to concentrate on core operations and growth strategies without constant fear of financial ruin due to lawsuit costs.

Enhanced Credibility and Trust with Clients

Having general liability insurance can significantly bolster your business’s credibility. When potential clients or customers see that you carry this type of coverage, they often perceive your business as more professional and responsible. This perception stems from the fact that insured businesses are viewed as being prepared to handle unforeseen incidents, thus minimizing risks for everyone involved. Client trust is another crucial benefit that comes with general liability insurance. In today’s market, informed clients actively seek partners who can provide assurance against potential liabilities. By demonstrating that you have taken steps to safeguard against claims, you position your business as a reliable choice, increasing your chances of securing new contracts. Many clients prefer to engage with insured businesses to protect their interests, knowing that any mishaps will be covered without direct financial losses on their part. Consider how general liability insurance plays a pivotal role in maintaining a professional reputation. For instance, industries such as construction and real estate often require proof of insurance before contracts are awarded. This requirement ensures that only businesses capable of handling liabilities are entrusted with significant projects. Insurance not only acts as a protective measure but also serves as a testament to your commitment to ethical and responsible business practices. Moreover, having general liability insurance can significantly enhance your ability to build and maintain strong client relationships. When clients see that you’re taking proactive steps to mitigate risks, it fosters a sense of trust and reliability. This trust is essential in establishing long-term partnerships and securing repeat business. Key Benefits: • Enhances perceived professionalism • Strengthens client relationships • Facilitates contract acquisition By investing in general liability insurance, you’re not just protecting your assets; you’re also investing in the future growth and success of your enterprise through improved credibility and trustworthiness in the marketplace.

Peace of Mind for Business Owners For small business

owners, peace of mind can be an invaluable asset. The unpredictability of unforeseen events—such as accidents or property damage—can create significant stress and anxiety. General liability insurance plays a crucial role in alleviating these concerns by providing coverage against such uncertainties. Psychological Benefits • Owning a business involves inherent risks, and the potential for incidents that could harm the business or its stakeholders is always present. • Having general liability insurance offers psychological comfort, knowing that financial support is available if unexpected claims arise. • The assurance that your business is protected from certain liabilities allows you to focus on daily operations without the constant burden of what-ifs. Contribution to Risk Management • Effective risk management is vital for sustaining and growing a small business. General liability insurance is a key component of this strategy. • With adequate coverage, you can implement risk management practices with confidence, knowing that you have a safety net in place. • This insurance empowers business owners to make bold decisions and seize new opportunities without being hindered by fears of financial instability. Financial Stability • By mitigating the financial risks associated with lawsuits and claims, general liability insurance safeguards your business’s bottom line. • It ensures that resources remain intact for growth and development rather than being depleted by legal battles or compensation payouts. In essence, general liability insurance not only protects your business but also enhances your ability to plan strategically and operate effectively. This bolstered sense of security translates into better decision-making and a more resilient business model.

Conclusion

Securing general liability insurance for small businesses is not just a suggestion—it’s an essential strategy for managing risks. By investing in this type of coverage, small business owners can protect their operations from unexpected claims and liabilities. The importance of general liability insurance for small businesses cannot be emphasized enough, considering that four out of ten small business owners are likely to face a claim within ten years. This insurance serves as a financial safety net, covering various expenses such as bodily injuries, property damage, and legal fees. For any small business aiming for growth and stability, prioritizing general liability insurance ensures that unforeseen incidents do not disrupt your progress or threaten your financial security. With the knowledge that you’re protected, you can concentrate on what truly matters—serving your clients and pursuing your business goals without constantly worrying about potential liabilitie